Most of us have heard of a job called accountant, but often do not know what is their duty although their role in this society is essential. This is because accountants are jobs that don’t emerge in our daily lives. So for this article, we’re going to search what is an accountant and its realities throughout an interview.

Basic information

Duty of accountants

Their duty is to handle a lot of financial data of the organization to make sure their owner(the organization) can make a critical financial decision. They usually achieve this goal by doing research, audits, data input, reporting, and so on. They are responsible for all organization’s finance management, including taxes, reconciling balance sheets, and more. So we can say that accountants are the legs of their company since if they stop working, the organization can’t handle their finances.

What skills are required for an accountant?

To be an accountant, of course, you need academic accounting knowledge. Also, you need to be strong at numbers and trends in business because you are also required to predict what will happen in the future and how the organization’s income and outcome will be affected by it. Below are the specific requirements suggested by Accountant Job Description: All Key Roles & Duties | TopResume.

Hard skills for an accountant job description

- Accounting

- Corporate Finance

- Reporting Skills

- Reporting Research Results

- Financial Data Entry Management

- Basic Math

- Accuracy

- Scheduling and Monitoring

- Problem Analysis and Problem-Solving Skills

- Active Learning

- Clerical Knowledge

- Proficiency in Microsoft Office

- Risk Analysis

- Tax Returns

- Certified Public Accountant (CPA)

- Accounting Software

- General Ledger Functions

- GAAP

- Balance Sheets

- Budgeting

- Data Analysis

- Bookkeeping

- Sarbanes-Oxley Act

- Financial Audits

- Certified Management Accountant (CMA)

- Certified Fraud Examiner (CFE)

- Certified Internal Auditor (CIA)

History of Accountant

Where did it start?

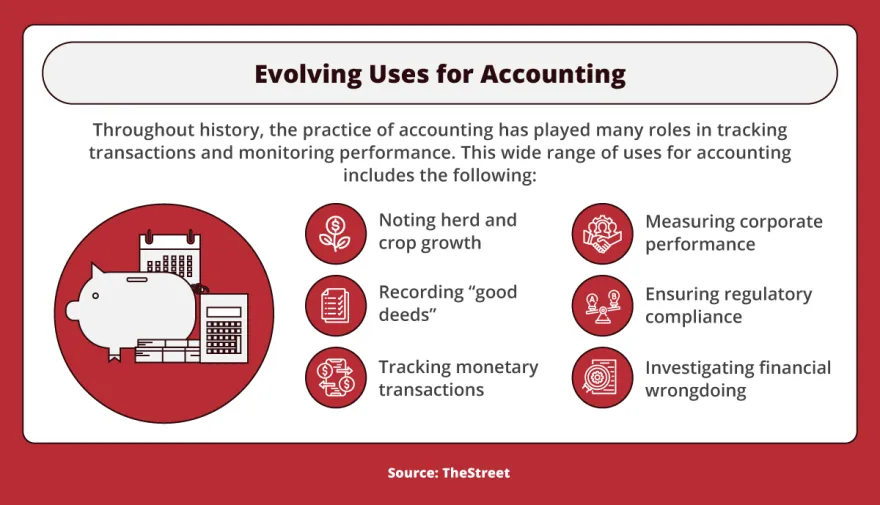

The initial accounting will go back to 3300 B.C. when tax information was recorded on clay tablets. However many scholars say that the practice started centuries earlier than this accounting’s first official record. Either way, accounting started a long time ago. The official record was discovered in Egypt, where Mesopotamia flourished. From this, historian believe that Egyptians were also using accounting not just to record their incomes and so on, but also “to monitor their pharaoh’s possessions and uncover fraud(History of Accounting: How It’s Evolved Over Time | Maryville Online)”

Emerge

Although accounting was not that complicated compared to these days, the practice became common after humans started from the Stone Age. Through their barter, they started to record what they had exchanged or loaned. This part of accounting history lasted until 1494. Below are the main aspects where accounting took place in those days written by “Maryville Online“

- Stone Age — Marking ticks on cave walls and mountains and in the jungle to record goods collected and loaned

- Primitive — Noting symbols on walls and making rope knots to designate transactions

- Barter — Recording deals made through barter for agricultural or other property

- Currency — Tracking monetary transactions, originally in Europe, related to transactions that bank loans financed

Preanalytic

During this period, accounting was not yet developed as an academic theory since there was no organization with a form of “company”, so individuals used accounting. On the other hand, fundamental parts of accounting for these days were developed. For example, emerge of Double-Entry Bookkeeping. This is the period from 1495~1799.

Development

This era is significant for accounting history. 3 main reasons lead accountings to develop. First is the Industrial Revolution. With the revolution, the world changed into a manufacturing-based economy which an enormous number of money moving compared to the past periods. Accounting was not for individuals anymore and sophisticated and efficient accounting methods became essential for accountants. This led to the development of an accounting theory to emerge. Second is a joint-stock company. This emergence made the economy more complex and increased the demand for efficient accounting methods to manage their finances with no confusion. Last is Government regulation. In this period, many governments started to revise their tax laws. To accommodate tax laws, the development of uniform accounting practices was initiated. This was during 1800-1950.

Modern

From 1951 to today, accounting theory has been shaped into what accountants use currently. Throughout history, uniform accounting methods have been established in each country to ensure true and fair reporting. For example in the USA, the accounting industry adopted generally accepted accounting principles (GAAP). On the other hand, these theories fluctuate depending on how the shape of society and economy change along with the flow of time. Accountants are required to adapt to those changes. So although it has a theory that is made by a long history, accountants cannot just follow the theory. They need to be always updated, or their company will lose their finances. That’s why it is and it will always be a demanding job.

Salary of accountants

3rd. Bermuda

Average salary: $85,070

This country is a British overseas territory and is located in the North Atlantic Ocean. This country is used by many people from abroad as a haven from tax. Companies located in Bermuda don’t have to pay any income tax. So many big companies came to this company, which led to an increase of jobs for accountants and they can expand their offshore industry (industry of financial and accounting operation in a country with a cheap tax)

2nd. Switzerland

Average salary: $103,970

This country might be unexpected for you since we don’t have a strong image as a country with a bunch of companies like the USA. But Switzerland is one of the lowest tax countries in Europe both for companies and individuals. So same pattern in Bermuda, there are more chances for accountants to get more jobs with high revenues.

1st. Cayman Island

Average salary: $182,929

Have you ever heard of this island? Well unless I never heard of it. But the salary is more than twice of Bermuda which is known as an international tax haven. This island is located just south of Cuba and the Dominican Republic. Most of its 65,000 citizens are located in the capital George Town. Wealthy international companies register their asset on Cayman Island, with trillions of dollars. This is because most of the taxes including corporate income tax, property tax, and other major taxes are free. Also, Since the island is located in the Caribbean Ocean, company is easy to transfer their money or properties to various countries like America, Canada, or the UK. So for accountants, the island is the easiest place to expand their offshore industry.

Famous companies such as Apple, Microsoft, and so on lots of big companies’ headquarters or startups are based in America. But for accountants, countries with low taxes make it easier to earn jobs, moreover to expand their offshore industry which they cannot expand in the USA because of its tax.

Interview

This time we interviewed an accountant in the Philippines. We met her by coincidence. We interviewed a woman who was selling a fried banana, and her main job was as an accountant. She had a little different life compared to other accountants, so let’s dive into it!

What is your job?

My job is an accountant. I used to work for an industry company as an accountant, but I quit and I’m doing accounting for my barber(if you are interested in her barber, read this article→debdebf). I started working as an accountant from 10 years ago.

What kind of skills do you use?

I often have analytical skills. The first thing I receive is just a chunk of numbers. I need to organize it and I have to analyze it. For example, if the selling is declining, there should be a reason. I have to describe the reason from another sort of a number like the number of imported materials and so on. I have to organize, connect, and analyze to lead to a solution from a number. So I use a lot of skills as an accountant, but the most important skill is analytical skill.

Why did you become an accountant?

My grandmother was an accountant, my father was also an accountant, and I was born in an accountant family. So it has been my dream job since child. Also, I loved analyzing things, so I also thought accountant suits my personality. If you don’t love your profession, you can not enjoy your work life.

What is a good point of doing this job?

You can apply your analytical skills to your daily life. Also, if you work as an accountant for a big company, it will not be individual work. Plural accountants are working for different parts of finance. So as I told you, to analyze numbers, we need to connect numbers from various parts of finances. So when the part you need is not in your jurisdiction, you have to cooperate with other accountants, and this often occurs. And this ability for teamwork, I use a lot after starting my own business.

What is a bad point?

If your report does not apply GAAP (principle) or has a mistake with numbers, it will be a big problem for the company. Of course, auditors check for mistakes, but they also make mistakes. When they overlook the mistake, it’ll have a huge impact on the company. So we always have a heavy burden of responsibility.

What is your dream?

Expand my business and be free from the restriction of money.